.webp)

Domestic Policy Missteps Drove Sri Lanka Into Crisis, Says Sri Lanka Central Bank Chief

COLOMBO (News 1st); Domestic policy missteps, combined with structural imbalances and successive external shocks, were key contributors to Sri Lanka’s 2022 economic collapse, Central Bank Governor Dr. Nandalal Weerasinghe said.

He noted that Sri Lanka faced 'one of the most severe economic crises in its history,' marked by a severe shortage of resources, widespread social and political unrest, and a significant loss of confidence in institutions and policymaking. Structural weaknesses and external shocks 'further amplified by domestic policy missteps' formed the root causes of the dual crisis.

Dr. Weerasinghe said persistent fiscal imbalances had pushed the country toward unsustainable debt levels and mounting balance-of-payment pressures, made worse by limited foreign inflows and the loss of global market access.

Inflation surged to unprecedented heights as the Central Bank’s foreign resources 'dried up to critically very low levels.' By early 2022, he said, the government had 'no option' but to announce debt sanctions on selected foreign resource payments.

Despite the severity of the crisis, he said decisive policy measures that followed resulted in 'one of the fastest economic stabilisation turnarounds seen in the recent emerging markets in recent history.' The government and the Central Bank, with support from the IMF Extended Fund Facility, worked closely with creditors and the international community to implement a comprehensive and coordinated reform programme, including a sovereign debt restructuring process. These reforms focused on restoring macroeconomic stability, rebuilding institutional credibility and building buffers for a more resilient and sustainable economy.

According to Dr. Weerasinghe, the results are now evident. After a deep economic contraction, Sri Lanka has recorded nine consecutive quarters of positive growth since the third quarter of 2023. He noted that although the fourth quarter of last year may show some setback due to the detour of a cyclone, the economy is expected to have grown by around 4.5% in 2025, with official figures due soon. He said the growth momentum is expected to continue, with projections of 4–5% for this year, describing it as steady medium-term growth.

He added that the country experienced rapid disinflation in 2023 followed by a period of deflation until August last year. Inflation has now returned to the Central Bank’s target level, currently around 2%, and is expected to move to around 5% by the second half of the third quarter this year.

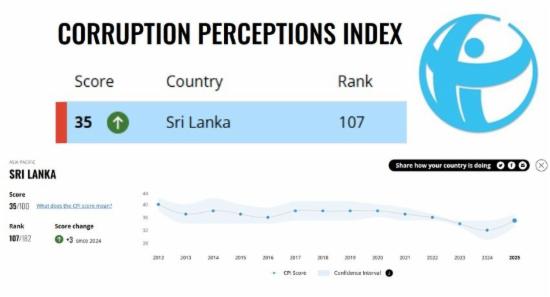

Dr. Weerasinghe also highlighted significant progress in governance reforms, citing numerous legislative enactments. These include the New Central Bank Act, the Public Finance and Management Act related to fiscal policy, and the Anti-Corruption Act aimed at addressing governance and corruption vulnerabilities.Several other reforms have also been enacted or are in the process of implementation. He said these improvements to the legislative framework support continuous macroeconomic stability and create 'an utmost stable framework for the future' in terms of overall macroeconomic stability.

Other Articles

Featured News

.png )

-822734_550x300.jpg)

.webp)