.webp)

Sri Lanka's VAT Changes: What You Need to Know

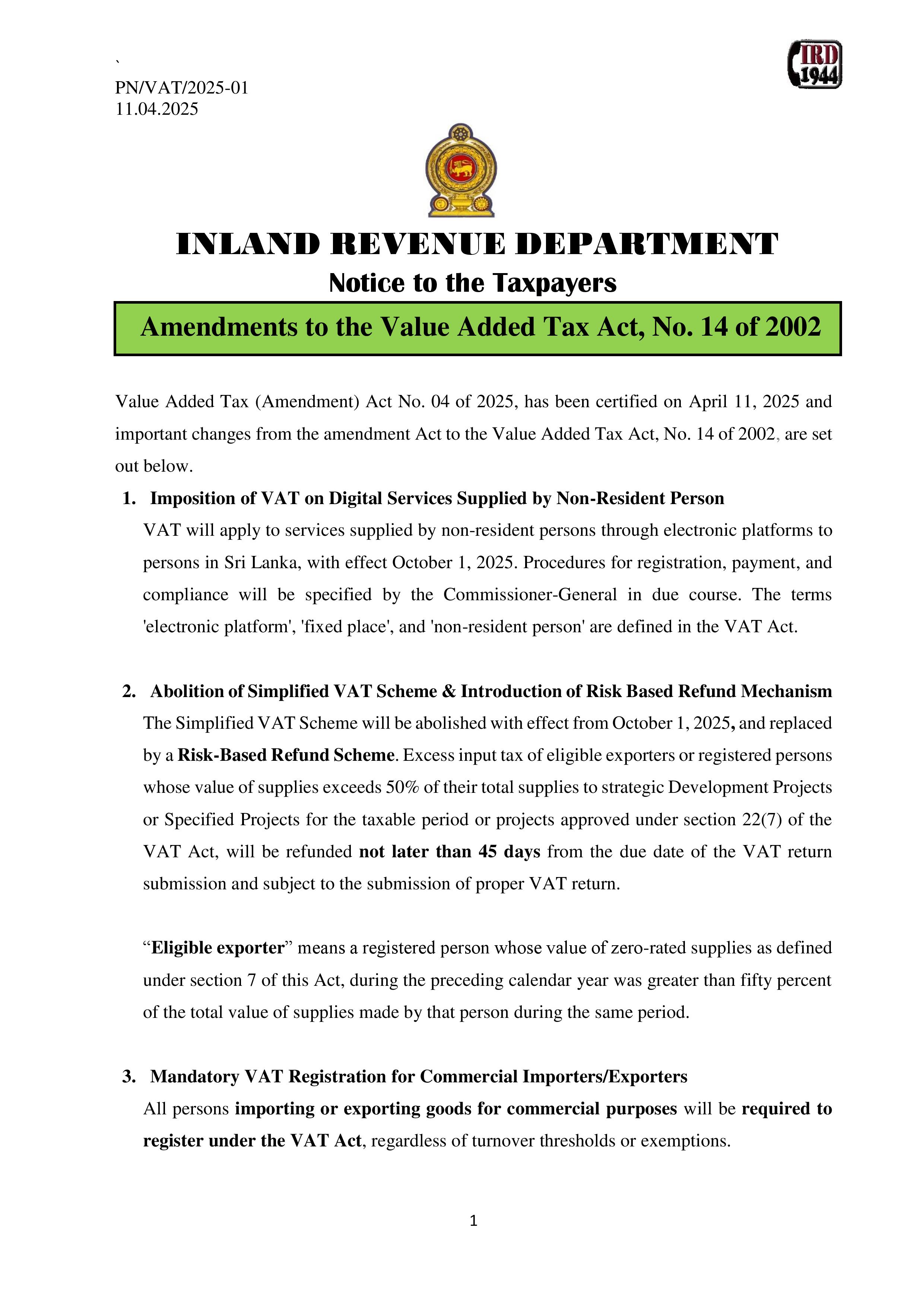

COLOMBO (News 1st); The Inland Revenue Department of Sri Lanka has announced several key amendments to the Value Added Tax (VAT) Act, No. 14 of 2002, following the certification of the Value Added Tax (Amendment) Act No. 04 of 2025 on April 11, 2025.

VAT on Digital Services:

Starting October 1, 2025, VAT will be imposed on digital services supplied by non-resident persons through electronic platforms to individuals in Sri Lanka. The Commissioner-General will provide detailed procedures for registration, payment, and compliance in due course.

Abolition of Simplified VAT Scheme:

The Simplified VAT Scheme will be abolished from October 1, 2025, and replaced by a Risk-Based Refund Scheme. Eligible exporters and registered persons with supplies exceeding 50% to strategic or specified projects will receive refunds within 45 days of VAT return submission, provided proper documentation is submitted.

Mandatory VAT Registration for Importers and Exporters:

All commercial importers and exporters will now be required to register under the VAT Act, irrespective of turnover thresholds or exemptions.

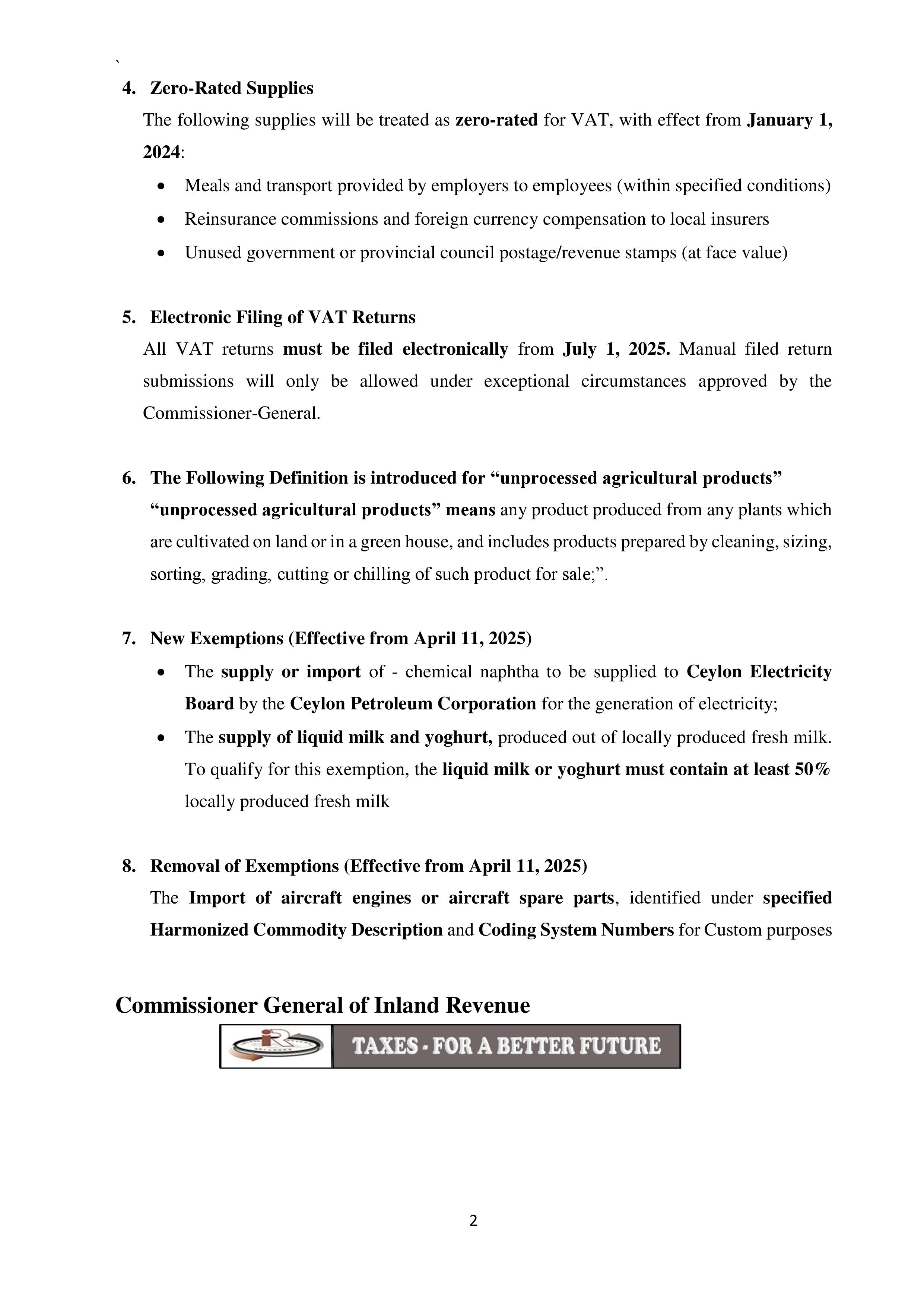

New Exemptions:

Effective April 11, 2025, the following exemptions have been introduced:

- Supply or import of chemical naphtha for electricity generation by the Ceylon Electricity Board.

- Supply of liquid milk and yogurt produced from at least 50% locally produced fresh milk.

Removal of Exemptions:

The import of aircraft engines or spare parts, identified under specified Harmonized Commodity Description and Coding System Numbers, will no longer be exempt from VAT.

These amendments aim to enhance the efficiency of the VAT system, support local industries, and ensure compliance with international tax standards.

Other Articles

Featured News

.png )

-788259_550x300.jpg)

-788253_550x300.jpg)

-788241_550x300.jpg)

-785316_550x300.jpg)

.webp)